Credibility and Premium Valuations II - SaaS Data & Analytics

In my last post, I compared the free solo climber and the tech bootstrapper in a piece that many of my past M&A clients have identified with. Per a request from a handful of current clients as well as other SaaS entrepreneurs, I am going to add to my previous post on the importance of credibility in premium valuation transactions for SaaS bootstrappers in my post today.

In my previous post on credibility, we introduced a three factor framework for optimizing valuation-enhancing credibility in M&A, discussed some reasons why buyers and sellers sometimes “miss” each other despite a strong fit, and introduced the idea that a credible bid environment helps to maximize buyer interest, competition, and valuation.

Figure 1: seller credibility in M&A transactions (data & analytics highlighted)

Today, we are going to begin digging into one of the three factors previously discussed: data and analytics (highlighted in light blue in the Venn diagram image above). In doing so, we will discuss why such metrics are so critical in establishing a premium valuation bidding environment (we will discuss why each metric is important in a future post).

Over time, strategic buyers and financial sponsors (private equity firms) alike have built pattern recognition and best practices around data-driven validation of an acquisition target’s growth trajectory. Given the nature of bootstrapped businesses, most are not in a position to tell their growth story through clean data without doing some meaningful work. If not shored up prior to an M&A process, this can bring management vision into question, increase the costs of buy-side (acquirer, majority or minority investor) participation, limit process participants’ willingness to continue on a non-exclusive basis, and ultimately hurt a company’s valuation and other transaction terms. Taking the time to understand what metrics are critical at the transaction stage and then doing the work to prepare such data helps deliver a safeguard against these dynamics and – along with business performance during an M&A process – fosters an environment that delivers a market best-positioned to pay a premium valuation with seller-favorable terms.

While the nuances of KPIs and what buyers look to learn from each of them can be complicated, the reason that they matter is quite simple: while historical business performance indicates inherent business value, by far the most significant determinant of future enterprise value (and whether the buyer / investor was successful in their acquisition / investment) is growth. Industry KPIs provide a window into how likely a business is to continue (or accelerate) on a strong growth trajectory post deal and are, therefore, critical in validating a company as growth-ready, the critical determinant of sustainable value and a buyer’s justification for a premium multiple.

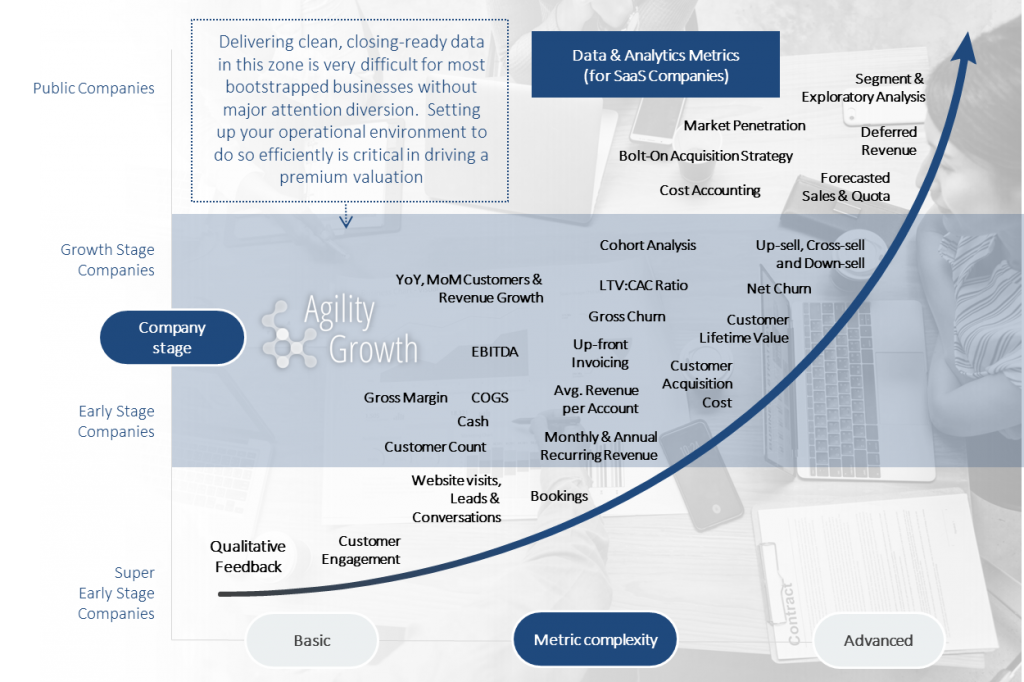

The visual below provides insights into company stage as well as the important metrics that a buyer / investor will look for in the “growth” stage that is common in high-multiple, premium M&A (as well as growth buyout and growth investment) transactions.

Figure 2: important SaaS metrics (highlighted) in high-multiple capital markets transactions

While each of the metrics in the foregoing chart is nuanced in what it can tell a buyer / investor about a business, the “evidence” combines to deliver a business validated as growth-ready and future fortified (i.e. worthy of “premium value if the metrics compare favorably to other market participants) due to signals triangulating around the following factors, among others:

-

- Product quality

- Mission criticality of the product to customers

- Operational efficiency

- Management vision

- Sales & marketing efficiency

- Growth financing from operations (i.e. cash collection cycles)

- Latent growth potential in current customer base

- Addressable market and customer segment sustainability / stickiness

While I am getting dangerously close to my 1,000 word limit for this post and need to cut this short, they say a “picture is worth 1,000 words, so with two images and a mashup “featured image,” I think we can count this post as “content rich” in laying the foundation for an ongoing discussion about SaaS metrics (happy to write posts on other industries’ key metrics as well) and how they work together with vision and execution to create a credible environment for driving premium M&A valuations.

After taking a one-post break from our series on “Credibility and Premium Valuations,” I will dedicate a post to covering each of the KPIs highlighted in blue in the image, including commentary on why / how each signals a business as growth ready to buy-side process participants. We will also deliver future posts on various categories of buyers and what each categories thinks and does when such metrics are available and clean vs. not available or messy.

Finally, future data & analytics posts will also cover timing for improving your data & analytics backbone, challenges that companies face in doing so, and why a good advisor should play a critical role in helping you prepare your due diligence environment (data and otherwise) for a transaction that delivers a credibility environment to bidders and a premium valuation to ownership. I am sure we’ll get to other points as well, though these are good for now.

Note: in my next post, I will get back to my series on the Asset Purchase Agreement.