Sharks & Mergers, Acquisitions IV: “Marine” Conditions & Tying it Together

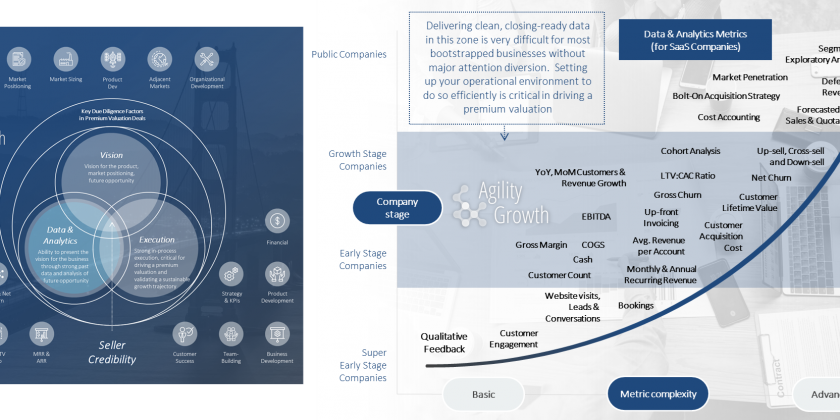

Sharks & Mergers, Acquisitions IV: "Marine" Conditions & Tying it Together As I mentioned in three other posts, in the technology ecosystem, it is good for (many) buyers to be active, just as an abundance of sharks signals a healthy marine ecosystem. However, it is still good to guard against “Jaws” and other circumstances that are likely to lead to an "attack" on your M&A outcome as a seller. In addition to the buyer landscape (i.e. sharks), there are a number of other inputs that swimmers (sellers)…