Sharks & Mergers, Acquisitions IV: "Marine" Conditions & Tying it Together

As I mentioned in three other posts, in the technology ecosystem, it is good for (many) buyers to be active, just as an abundance of sharks signals a healthy marine ecosystem. However, it is still good to guard against “Jaws” and other circumstances that are likely to lead to an "attack" on your M&A outcome as a seller.

In addition to the buyer landscape (i.e. sharks), there are a number of other inputs that swimmers (sellers) should consider before engaging with buyers (sharks):

Environment: in the shark analogy, environment includes things like water temperature (are you going to get hypothermia), location (are the sharks in the area known to be aggressive / more like “Jaws”?), time of day (is the lighting low / i.e. is the shark likely to get confused), feeding habits (is the area a feeding zone and are the types of food likely to cause human / food confusion), etc. In the case of a seller, these amount to the M&A process architecture as well as questions like:

- How many buyers are you talking with and from which categories (i.e. PE, strategic, hybrid)?

- Is the due diligence environment set up in a way where the business will look as good as possible to each category of buyer as well as each distinct buyer? Are you answering more questions than you are creating?

- Who is your advisor? Is the advisor likely to make you look more or less credible later in the process? For example, we compete with a firm on a regular basis that we know blames process missteps on its clients vs. taking ownership for mistakes. This is like dropping blood around the swimmer (client) from the safety of the boat.

Distance to land / watercraft: this is pretty straightforward. If you are in open water, in an environment that you are not used to, you want to be able to reach land or a boat very quickly. In the M&A analogy, “proximity to land / watercraft” could be addressed through favorable answers to questions like:

- How much leverage are you getting from your advisor?

- Has your advisor set up the process and their efforts in a way that allows you to take a breather if necessary?

- Has the work been done early enough to allow you to hit your numbers during the process?

- Have you maintained a position of strength, security, and credibility by using non-exclusivity to your advantage?

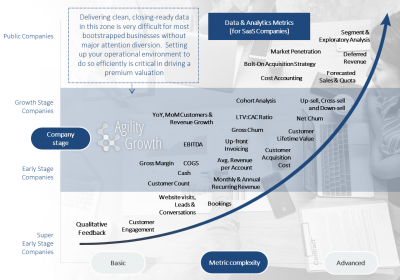

Unfortunately, most advisors do not do the work early (or at all) that should be done to ensure that the process itself does not damage the swimmer, thereby attracting sharks…or even leading the company to “drown” in the process. While you might not be “eaten,” you can perish nonetheless. My practice has been built around layering a bunch of operational services related to data analysis, accounting, CFO-level financial analysis, due diligence materials authorship, legal… essentially providing the full suite of services that are common for large, heavily-funded businesses to have in-house but that are very common problem areas in a process for bootstrappers. It is how we keep our clients “close to land” at all times as well as maintain a credible environment where sharks are highly unlikely to cause any trouble and, rather, must simply engage in a deal on our terms.

Weather: this is a quick one. If the waves are choppy, it’s windy, cold, etc., the environment for swimming with sharks it unlikely to yield the desired results. Even if they don’t attack you, the swimmer is highly unlikely to be able to engage with the sharks in the desired manner. The same is true in an M&A process. If not architected to be managed at a time where the business does not face figurative headwinds / bad weather, it makes it much more difficult to interact with buyers in a way that will yield the desired outcome. Thus, timing becomes important to consider. When will the business be likely to achieve strong operational results with the least amount of friction? When are employees most eager to carry extra weight? When are the founders least likely to have their attention diverted to non-business activities like vacations, family weddings, moving to a new home, etc.? You get the picture. Make sure to run your process at a time when the water will be “glass” the sky “clear” and no storm clouds are on the horizon.

Image: Discovery Channel

Fitness / other: As was previously stated, health of the business is very important so that we don’t have a mistaken identity situation / one where sharks are almost forced to behave badly due to their nature (their goal is have a high return and paying a “low” price can be justifiable part of that). Ensuring that the business is maximally “fit” for the swim is important and can achieved by:

- Having detailed conversations between key seller constituents to ensure that relationships are all healthy and that there are no lingering tensions. This is especially true among founders. If there are issues, work with an advisor who is good at mediating, helping each party see the other’s point of view, etc. If there is one thing outside of poor operational results that will be akin to “blood in the water” in the minds of buyers, it is a deteriorating relationship between sellers; it’s usually perceived as a desperate signal that a deal “has to happen” and therefore a reason for the seller to accept a below-market price.

- Ensuring that company financial statements are “clean” and that there are not significant discrepancies when comparing the financial statements to core operational data, information from payment partners, etc. That is also includes conforming company books and records to generally accepted accounting principles (“GAAP”).

- Running the process when you know there is a high likelihood that you will achieve your operational objectives, including financial results, operational KPIs, and product development initiatives.

- Making sure your advisor / trainer is a good “spotter” and will naturally see when the company needs help to keep healthy, hit its numbers, etc. Only work with a strong (and capable) advisor who is ready to life the weight for you if needed rather than watching you flounder and blaming you for it as the sharks circle.

- Working to reach a state of “Zen” on a personal level before and maintaining it during the process. It will be a stressful time and it is important to proactively find time to stay physically and mentally healthy if your desired outcomes are to be achieved.

Conclusion

Tying it all together, it is important to note that very active (ones reaching out to you) investors and acquirers are a sign of a healthy ecology in tech; as a future seller, you should want them around. These safe buyers are willing to compete and the goal in engaging them is more about finding the right partner vs. protecting yourself from a “shark attack.” The place to be wary as a seller is when you find yourself in a “one-off” negotiation with a buyer, either responding to inbound interest sans sound advice or when you enter into an “exclusivity agreement” with a single buyer, thereby eschewing your ability to engage additional suitors. In such cases, it is hard to escape the predatory instincts of buyers who make their money by investing at the lowest price possible. After all, in situations like this, you may be the most calorie rich (cheapest / highest return) deal they’ll see in a year (because it is proprietary / not part of an advisor-curated process). Other key takeaways from this series include:

- The market will speak to you in many ways over time, including through buyers “circling,” other deals getting done in your market, through industry change, etc. When it speaks, you should listen, take note, and be thoughtful. A market speaking does not mean you should be a seller, but it does mean you should be deliberate about your moves. When the sharks leave, sometimes your chances for a premium deal leave for a while too.

- Like sharks, buyers and investors are very good at “sniffing out” quality targets. It is in their DNA and it is how they stay alive. Often awards won, strong press, signs of growth (like LinkedIn headcount growth), etc. can serve as business quality “chum” in the water that will attract buyers to your company.

- There are many good reasons that the “ideal” partner might not find you, so it is good to run a process to attract, engage with, identify, and close a deal with your partner of choice. If you don’t, it becomes more likely you will miss a potentially golden opportunity.

- Bad actors do exist in M&A, so it is important to safeguard your business as well as your M&A process from the M&A / investment equivalent of “Jaws”

- With the right expertise, you can identify the “ fair / premium exchange of value” sharks from the predators or the “value” buyers based on their behavior in a process

- Other things matter in an environment you’re not familiar with (similar to the ocean vs. land) and using an advisor will keep you safe with stories to tell.

...and, that'll do it for our series comparing the ocean, sharks, and M&A. Off to talk with a cool company that has been swimming for a while and is now considering a deal!

As always, happy to discuss these concepts and any others that you are interested in.

Note: I love connecting with like-minded finance folks, entrepreneurs, and other humans. Feel free to connect with me on LinkedIn and / or Twitter if you’re so inclined.