Credibility and Premium Valuations, Part I – Three Factors

In my last post, I continued a section by section analysis of an asset purchase agreement (APA). Today, I am going to take a break to begin talking about one of the most fundamental considerations in premium valuation transactions for technology bootstrappers: credibility.

“Credibility” is something that is very common for people to talk about but much less common for individuals to define in any given setting. Executives, analysts, professional athletes, employees, and just about everyone else, including M&A actors, either implicitly or explicitly consider the credibility of the person (or company) on the “other side” when making a decision. At home, that decision might relate to a parent’s belief (or lack thereof) that her teenager will make curfew if allowed to attend a concert. And in the M&A world, the “credibility” verdict often drives what is commonly considered the most important factor in the deal / no deal calculation: valuation. Is the price fair? Does it consider the true strategic “value” of the target? Does it come at a premium; or does it come at a discount? In a word: is the valuation “credible” given all factors?

Unfortunately, I have heard of many cases where excellent buyers and phenomenal sellers “miss” each other in the credibility calculation and valuation suffers, leading to “no deal.” This is especially troublesome when a deal actually should happen because a real strategic and cultural fit is there; however, because credibility breaks down at some point, an economic fit is not achieved. These are situations where everybody loses, bankers on both sides should be fired, and the world (for customers, shareholders, employees) would be better with a “do-over.” Since do-overs are tough to come by, it is valuable for both sides in an M&A equation to consider how to optimize credibility and why it sometimes breaks down. Some reasons credibility can suffer in a deal, especially in the case of bootstrapped businesses where information can be sparse without proper advice, include:

-

- Seller feels that buyer “only cares about the numbers” and “doesn’t see the upside”

- Buyer truly has not done enough work to validate a strong strategic fit and latent business potential / upside

- Seller does not have a handle on its KPIs, the financials are a mess, or due diligence will be prohibitively expensive for a buyer to validate because the seller’s “house is not in order”

- The proper exchange has not taken place where seller effectively conveys and buyer effectively receives the information necessary to validate the tremendous fit.

- …and a long list of others factors.

Each of the foregoing can become particularly challenging in an M&A environment where information is purposefully held back to optimize a competitive bid environment or to minimize the fallout from actual or perceived industry-specific competitive dynamics.

Fortunately, steps can be taken to significantly improve the chances that an actual cultural and strategic fit matches with economic fit. I will talk about many of these steps in great detail over time and in a series of credibility-related blog posts. For today (because my son’s soccer game starts in 50 minutes), I will simply introduce one framework that I have found to be true time and time again in the premium valuation transactions that I have architected for bootstrapped technology companies. The framework includes three primary factors that seller and advisor can optimize to ensure that a market-leading vision and product is deemed credible and fortified for growth by market participants, leading to a premium valuation and lower risk profile when compared with other transactions for similarly-situated companies.

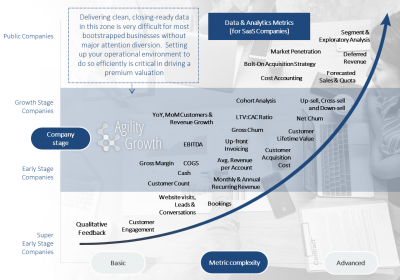

The factors that buyers must validate during due diligence in order for seller to achieve a premium valuation include 1) vision; 2) the data and analytics supporting management’s vision as well as a top-of-market product; and 3) strong in-process operational execution. Each of these factors has a multitude of layers, some of which are presented in the visual below for a bootstrapped SaaS business. I’d be happy to provide similar graphics for other classes of bootstrapped tech companies in the future if there is interest.

Delivering clean, market-ready, and diligence-fortified information (data and otherwise) in each of these three areas is often extremely challenging for even the most buttoned-up bootstrapped business, at least without major diversion of critical operational focus. That is why I have spent the bulk of my career architecting an M&A process that bridges this and similar valuation-enhancing (or minimizing) gaps. I’m always happy to discuss in detail with anyone seeking advice, those looking for a debate, and even with those that disagree (though an average double-digit revenue multiple in my M&A deals over the past 4 years would stand as pretty good corroborating evidence on my side).

Finally, I’ll add a bunch of related posts to the M&A credibility theme in the future and will also try to come back to this first post with cross-links to future posts. In my future commentary, I will include observations related both to the import of credibility in aiding a seller’s pursuit of a premium valuation and in a seller’s efforts to validate the credibility (or lack thereof) of those on the buy-side.

OK – off to the soccer game. Micro (Mike Jr.) is primed for a big one today after a week of practice in our home gym!